As of July 1, 2020, an MSME (Micro Small and Medium Enterprise) will be referred to as Udyam, and the enrollment or registration process will be referred to as Udyam Registration, according to the most recent notification issued by the Indian government.

A new Udyam registration certificate is issued by the Indian government to confirm the company’s existence. Additionally, all Udyam-affiliated businesses can take advantage of a variety of advantages provided by the MSME Ministry’s various wavelength schemes for the protection and expansion of Indian small businesses.

Anyone who wants to start a micro, small, or medium-sized business needs to sign up for Udyam and register as one at the online Udyam Registration portals. The company will then receive an e-certificate titled “Udyam Registration Certificate” and an Udyam Registration Number.

All existing Indian businesses must file and register as Udyam by March 31, 2021, per the notification issued by the Ministry of MSME. By verifying or seeding Udyam registration with the PAN, the previous Udyog Aadhaar Memorandum can be updated.

The Ministry of MSME for Businesses has designated the registration of new businesses as Udyam.

The MSME notification from the Indian government states that there will be no application fees or payments required to complete the form of Udyam Registration in Bangalore.

Only the Aadhaar number, GST, and PAN (self-declaration) are required for Udyam Registration in Bangalore.

Eligibility for Udyam registration

The Udyam Registration in Bangalore can be obtained by any kind of business unit.

- Proprietorship

- HUF

- Co-operative societies

- Partnership firm

- Any association of firms can get Udyam Registration in Bangalore.

- LLP

- Private limited or limited company

- OPC can get Udyam Registration in Bangalore.

The MSME Ministry stipulates that the following conditions must be met: turnover and investment in plant and machinery or equipment.

Microenterprise

Units of micro-businesses are now defined as businesses with a turnover of less than five crore rupees and an investment of up to one crore rupees.

Small Enterprise

Small enterprise units will now refer to businesses with a turnover of fewer than 50 crores and an investment of up to 10 crores.

Medium enterprise

Medium units will now be the business with investments up to Rs 50 crore and a turnover of less than Rs 250 crore.

As can be seen, there are numerous advantages to Udyam Registration in Bangalore.

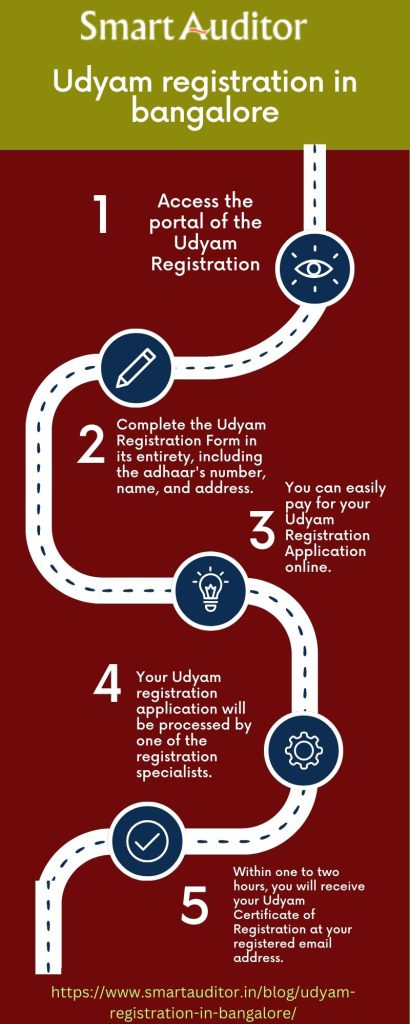

The online registration procedure is relatively simple because it no longer necessitates the uploading or submission of documents and is a paperless method.

Benefits

There are numerous advantages to Udyam Registration in Bangalore; here are some of those advantages.

These benefits are listed following the MSME Ministry’s plans for developing Indian micro, small, and medium-sized businesses. Holders of Udyam registration certificates may also benefit from the same benefits and find them useful.

- Special favourable reservation policies in the manufacturing and production sector

- Facility to get registrations, licenses, and approvals for MSME-registered entities

- MSME-registered entities become eligible for CLCSS (credit-linked capital subsidy scheme)

- Special attention to the international trade fair Government security deposit (EMD)

- waiver (Useful while participating in tenders)

- Electricity bills concession when you have Udyam Registration in Bangalore.

- Patent registration subsidy

- Barcode registration subsidy is obtained when Udyam Registration in Bangalore is done.

- Waiver of stamp duties and registration fees

- ISO certification fees refund Direct tax laws provide for an exemption

- Subsidy for NSIC performance when you have Udyam Registration in Bangalore.

- MSME schemes launched by the government

The government has launched several programs for MSME businesses. The following are the plans: Hence Udyam Registration in Bangalore is crucial.

Zero defect scheme

By producing goods that meet specified standards and can be exported, MSMEs can participate in this scheme.

The primary objective of adhering to the standards is to ensure that the products will receive favourable feedback and gain widespread acceptance in global markets.

Tax reductions and concessions on exported goods round out the benefits. Thus Udyam Registration in Bangalore is necessary.

Incubation scheme

The government encourages and supports MSMEs that introduce novel designs, concepts, and products to the market.

Under this program, the government takes care of up to 75% to 80% of the financial costs associated with such innovative products. So Udyam Registration in Bangalore is crucial.

Udyog Aadhar memorandum scheme

To take advantage of this program’s benefits, one must have a mandatory Aadhaar card. This plan gives you easy access to loans, credit from the government, and financial aid. Hence Udyam Registration in Bangalore is important.

Tools for Quality Technology and the Standard for Quality Management

In addition to adopting cutting-edge technology, MSMEs that have Udyam Registration in Bangalore are required to maintain standard quality. As part of this program, the government educates new MSMEs about the market’s new technologies through a series of seminars and expert sessions.

Women entrepreneurship scheme

The government encourages women entrepreneurs through this program by providing them with capital, loan assistance, training, and counselling.

And technical methods that will help them operate their MSMEs independently which has Udyam Registration in Bangalore. Additionally, it aids women in expanding their MSMEs.

Credit-linked capital subsidy scheme

The government encourages women entrepreneurs through this program by providing them with capital, loan assistance, training, counselling, and technical methods that will help them operate their MSMEs independently.

Additionally, it aids women in expanding their MSMEs that have Udyam Registration in Bangalore.

Grievance monitoring system scheme

This program gives registered MSMEs through Udyam Registration in Bangalore, the ability to file complaints, monitor their progress, and continue filing them if they believe the outcome is unsatisfactory or praiseworthy.

MSME Udyam registration penalty

Following Section 27 of the Micro, Small, and Medium Enterprises Development Act of 2016, individuals who intentionally conceal or misrepresent the self-declared facts that are required to be provided during the Udyam Registration in Bangalore or the update process are subject to a fine of up to one thousand rupees upon first conviction.

The fine for a subsequent conviction will range from one thousand rupees to ten thousand rupees.

A fine of not less than ten thousand rupees will be imposed on the businesses if it is determined that they have not provided the audit details required by Section 22 of the MSME Development Act, 2016.

Conclusion

Manufacturing and service-based micro, small, and medium enterprises are examples of small-scale industries.

Because they account for nearly one-third of the country’s GDP, MSMEs are regarded as the foundation of the Indian economy.

Although “Udyog registration” offers MSMEs numerous benefits, the government has not mandated that MSMEs register with the Udyog portal.

The MSMEs have been reclassified in light of both investment and turnover as part of the revised registration process.

Get Udyam Registration in Bangalore online through the “Udyog Portal” and take advantage of government benefits.

About Smartauditor

Smartauditor is the best service provider. We have many branches. And we serve across India.