For non-profit organizations, the three legal forms of companies in India are trusts, societies, and Section 8 companies.

There is no central law for Indian Trusts; State-by-state legal and institutional frameworks for Indian Societies vary, while the Companies Act of 2013 serves as the national standard for Section 8 businesses.

A Section 8 Company is more strictly regulated and supervised than trusts and societies thanks to this strong act, which governs its formation, management, and accountability.

What is Section 8 Company?

A company classified as a Section 8 is framed to promote commerce, arts, science, schooling, research, sports, charity, social government assistance, religion, environmental protection, or some other object. It can get Section 8 Company registration in Bangalore.

It intends to promote these goals with all of its profits, income, and other earnings.

Members don’t get any money or dividends.

Without the word “limited” added to their names, these limited liability companies, which are registered under the Companies Act, will be treated as such.

They could have been listed as “private limited companies” or “public limited companies” on their registration papers. Thus they can get Section 25 Company registration in Bangalore.

Section 25 Company, enacted under the Companies Act of 1956, is an earlier version of “non-profit organizations (NPOs) or non-governmental organizations (NGOs)” and is referred to as “section 8 companies” in law.

Any place in the nation can be used as a Section 8 company. And also they can get Section 8 Company registration in Bangalore.

Eligibility

For a Section 8 Company to have Section 8 Company registration in Bangalore, in addition to the three bullet points listed in the definition above, the following requirements must be met:

Can have Section 25 Company registration in Bangalore under the Companies Act 2013.

License to be applied to MCA.

Directors:

A private limited company must have at least two directors, while a public limited company must have three.

Indian resident

For having Section 8 Company registration in Bangalore, (Section 149(3)) At least one director must be a resident of India and have spent at least 182 days there in the previous year.

MOA Subscribers

The MoA must have at least two or three subscribers if the Company is to be incorporated as a private or public company.

MOA & AOA

Determine the requested name, the company’s objectives, the location of the planned registered office, the number of directors and promoters, the authorized capital, and the number of shares each promoter will subscribe for.

They should refer to the methodology set up to meet your social targets. It is within the authority of the ROC (Registrar of Companies) to inquire about it.

Initial capital

Within two months, the proposed initial capital for the business must be invested.

Property management

The property is owned by the company and can only be sold following the Companies Act’s guidelines (for instance, with approval from the Board of Directors in the form of a resolution).

Dissolution

Only following the bylaws of the society can the Section 8 Company be liquidated.

The assets and property of the general public are not to be dispersed among the individuals from the organization upon disintegration and after the instalment of all obligations and liabilities.

The remaining funds and assets, on the other hand, would be given to or transferred to an additional Section 8 company with a similar objective.

Annual compliance

The company is required to submit annual returns, statements, and accounts to the ROC to comply with the established standards. Hence Section 25 Company registration in Bangalore is important.

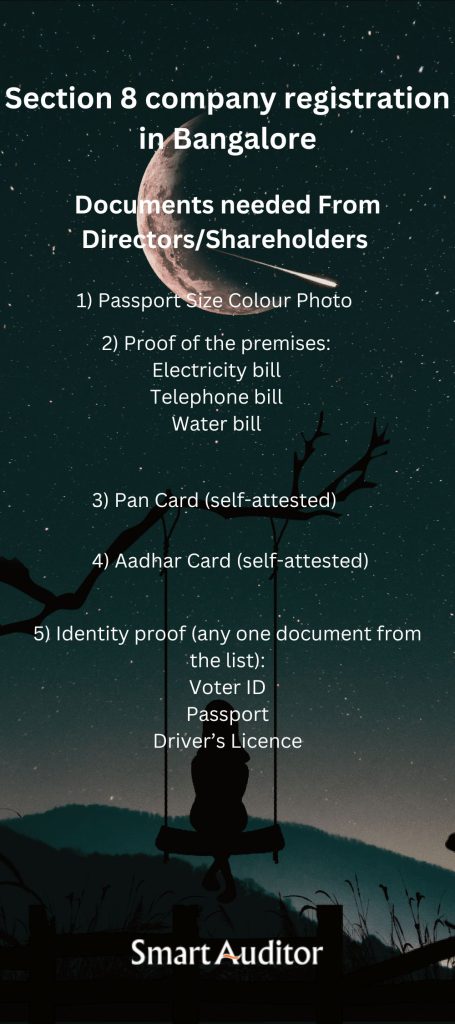

Documents

A current DSC (Digital Signature Certificate) and DIN (Director’s Identification Number) are required of each Director for Section 25 Company registration in Bangalore.

Features of Section 8 Company registration in Bangalore

Being an NPO or Non-Profit Organization doesn’t block the organization from creating a gain or procuring pay. It simply indicates that the promoters will not benefit from the company’s profits.

The promoters cannot split the profits. The object must be promoted with all profits. Nevertheless, Section 8 Company registration in Bangalore provides “NGO and NPO” with certain benefits and exemptions.

However, Section 8 businesses that have Section 8 Company registration in Bangalore receive numerous advantages:

Separate Legal entity

The members of the Section 8 Company with Section 8 Company registration in Bangalore are not the same legal entity. In addition to having more organized operations and greater flexibility, the business exists forever.

No stamp duty

The Memorandum of Association (MoA) and Articles of Association (AoA) of a private or public limited company, which are required for the registration of other types of company structures, are exempt from paying stamp duty to a Section 8 company. It can have Section 8 Company registration in Bangalore.

No minimum capital requirement

India does not have a minimum capital requirement for Section 8 Company registration in Bangalore. In addition, the capital structure can be altered at any time to meet the expanding requirements of the business.

This indicates that no share capital is required for its formation and Section 25 Company registration in Bangalore. After that, members and the general public’s subscriptions and/or charitable contributions can be used to raise the funds needed to run the business.

Name

A Section 8 company’s legal name does not need to include suffixes like “Public Limited or Private Limited.”

The names “Society, Association, Council, Charities, Club, Foundation, Institute, Academy, Federation, and Organization” can be used to register these businesses.

CARO

Section 8 companies with Section 8 Company registration in Bangalore are exempt from the Companies Auditor’s Report Order (CARO) requirements.

Tax benefits

Section 8 businesses in India can take advantage of numerous tax benefits after having Section 8 Company registration in Bangalore.

Credibility

Compared to other types of charitable organizations, Section 8 companies are more reliable. They are strictly regulated and bound by the Companies Act.

Such as the need for an annual audit that must be done every year and cannot be changed at any point.

These businesses are trustworthy when it has Section 8 Company registration in Bangalore because of the rules for managing their profits and losses.

Exemptions to donors

Sections 12A and 80G of the Income Tax Act grant tax exemptions to donors who make contributions to a Section 8 company.

Membership

Individual members of a registered partnership firm can become directors.

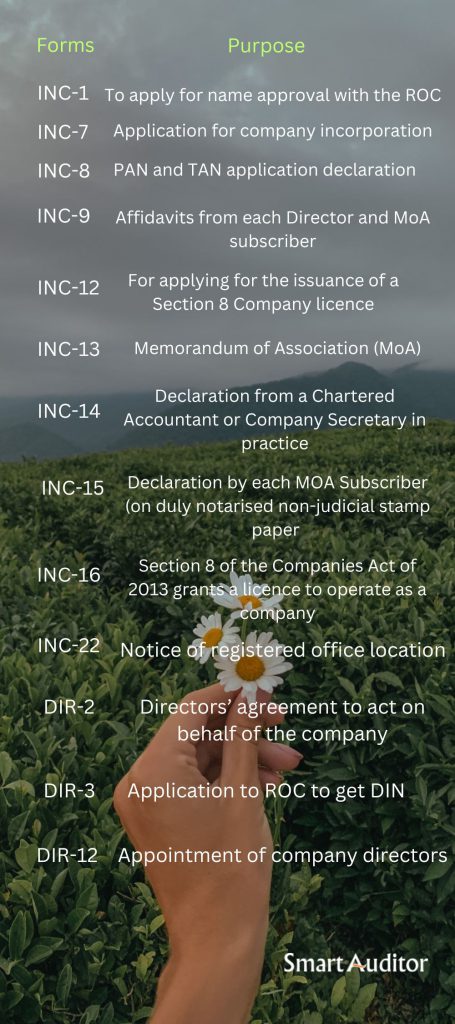

Forms used for Section 8 Company registration

FAQ

Is authorization from the central government required?

In India, Section 8 Company registration in Bangalore requires permission or approval from the central government. CG approval is needed before a section 8 company can be registered.

How long does the registration of the company last?

As long as the annual compliance requirements are consistently met, a company that has Section 8 Company registration in Bangalore will remain active and in existence.

If yearly compliances are not met, the organization will become lethargic and might be struck off the register sooner or later. A struck-off business can be brought back to life for up to 20 years.

Can foreign nationals and non-resident foreigners serve as Section 8 company directors?

An NRI or foreign national can be a director in a Section 8 company if they obtain a Director Identification Number. However, the Board of Directors must have at least one Director who is a resident of India. Also, it can get Section 25 Company registration in Bangalore.

Conclusion

In India, forming a section 8 company is the same as forming any other kind of company. The only significant difference is that Section 8 of the Companies Act of 2013 mandates a license from the central government.