Here in this blog, I am going to discuss about the impact of a PVT LTD Company Registration in you business. Normally, Starting a business is the key for the most interesting and rewarding experience in the business life cycle. That is the time for most entrepreneurs are starting their journey in the business entity. At first, they are choosing which entity they have to choose. As well as, It is an important decision and the result may impact greater variations in the upcoming future as well. So, consulting with a professional to discuss your business plan and choose the correct entity is an added advantages to support the vision of your Company.

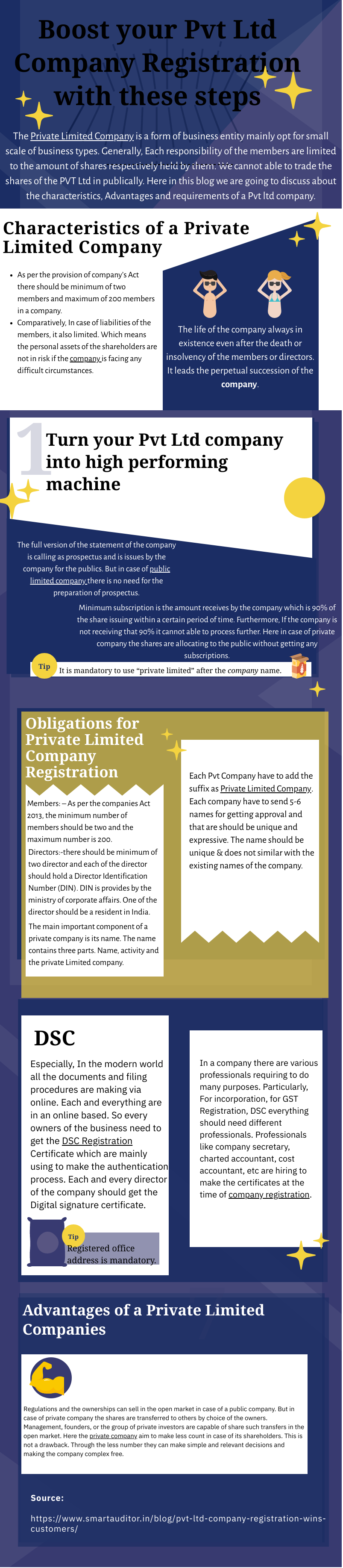

The Private Limited Company is a form of business entity mainly opt for small scale of business types. Generally, Each responsibility of the members are limited to the amount of shares respectively held by them. We cannot able to trade the shares of the PVT Ltd in publically. Here in this blog we are going to discuss about the characteristics, Advantages and requirements of a Pvt ltd company.

Characteristics of a Private Limited Company

As per the provision of company’s Act there should be minimum of two members and maximum of 200 members in a company.

Comparatively, In case of liabilities of the members, it also limited. Which means the personal assets of the shareholders are not in risk if the company is facing any difficult circumstances.

The life of the company always in existence even after the death or insolvency of the members or directors. It leads the perpetual succession of the company.

Additionally, The private company always having a privilege over the public company. So there is no necessary to keep an index of its members but it is not same as in public company. The public limited company always have to make & keep an index of its members.

Turn your Pvt Ltd company into high performing machine

In case of the number of directors, the private sector have only two directors.

Likewise, The paid up capital should be in minimum of 1 lakh

The full version of the statement of the company is calling as prospectus and is issues by the company for the publics. But in case of public limited company there is no need for the preparation of prospectus.

Minimum subscription is the amount receives by the company which is 90% of the share issuing within a certain period of time. Furthermore, If the company is not receiving that 90% it cannot able to process further. Here in case of private company the shares are allocating to the public without getting any subscriptions.

It is mandatory to use “private limited” after the company name.

Obligations for Private Limited Company Registration

The main Obligations for the private limited company registrations are.

Members: – As per the companies Act 2013, the minimum number of members should be two and the maximum number is 200.

Directors:-there should be minimum of two director and each of the director should hold a Director Identification Number (DIN). DIN is provides by the ministry of corporate affairs. One of the director should be a resident in India.

Notably, The main important component of a private company is its name. The name contains three parts. Name, activity and the private Limited company. Each Pvt Company have to add the suffix as Private Limited Company. Each company have to send 5-6 names for getting approval and that are should be unique and expressive. The name should be unique & does not similar with the existing names of the company.

DSC

Registered office address is mandatory. For registration the company have to give the temporary working space address. After it get registered the company’s main affairs have to conduct in the registered place and all the confidential documents are kept as secure.

Getting DSC

Especially, In the modern world all the documents and filing procedures are making via online. Each and everything are in an online based. So every owners of the business need to get the DSC Registration Certificate which are mainly using to make the authentication process. Each and every director of the company should get the Digital signature certificate.

In a company there are various professionals requiring to do many purposes. Particularly, For incorporation, for GST Registration, DSC everything should need different professionals. Professionals like company secretary, charted accountant, cost accountant, etc are hiring to make the certificates at the time of company registration.

Advantages of a Private Limited Companies

Here we are going to discuss with the advantages of a Private Limited Companies. Ownership, minimum number of shareholders, legal formalities, management & decision making, minimum share capital, confidential etc. There are enormous number of advantages in case of a private limited company. Let us discuss each.

Ownership

Regulations and the ownerships can sell in the open market in case of a public company. But in case of private company the shares are transferred to others by choice of the owners. Management, founders, or the group of private investors are capable of share such transfers in the open market. Here the private company aim to make less count in case of its shareholders. This is not a drawback. Through the less number they can make simple and relevant decisions and making the company complex free.

Minimum shareholders

The minimum is 2 for a private company. Whereas in case of a public company the minimum requirement is 7.

Legal bureaucracies

The legal formalities of the companies are sometimes very expensive & time consuming. The public company formation requires lots of legal formalities when compared with the private companies. But don’t worry about the private company formation. There exist comparatively shorter legal procedures.

Disclosing Data

The public company disclosing all the financial statements in every quarter neither it will affect the public investment. But private companies are quite different there is no such rules or regulations.

Decision making

The decision making and the managements are literally complex in case of public companies. Because there are more number of peoples and the company board have to be consulted with them. But it is less in case of a private limited company, as there are less number of shareholders.

Focus of management

Public company managers are focused to increasing the values of shares whereas the private companies are making flexible decisions in the short and long term journeys.

More Legal requirements

The private companies need not to worry about shareholder expectations and interference in the stock market pressure. The public company shareholders are only focusing on the current profits and incomes. They used to pressurize the company to make more earnings.

Share capital

The public limited company requires minimum share capital of Rs. 5, 00,000. But the private company requires minimum of Rs. 1, 00,000 at the earliest. But now there is such minimum requirements. There is no pressure in the fund management.

Confidential

The business secrets should be confidential. The competitors are not able to access your data. In Public companies the legal settlements, compensation details etc are not kept as reserved. Likewise, the information of the private company also secure and confidential.

Conclusion

If you want to register your Private limited Company in Coimbatore, Don’t Worry , we Smartauditor is here to save you from all the legal hindrances. transparent pricing with time consuming is centralized us from others. Our branches are located over Salem, Trichy and Erode. Do register and be stand out in the global Market.

Have a Happy Day !!!!

This Blog about Company registration is really fantastic. i really liked it very much. I can gain all the information related to register a company in my native. Keep writing. It’s really helpful.

This blog about Pvt Ltd Company Registration is really worth enough. I got many points for my upcoming Article post. Keep doing. Well done!

Very good content. Your writing skills are really attractive.