In India, the most common type of company registration is for a private limited company. Also in India, a pvt ltd company must have at least two shareholders and two directors to be incorporated.

And in India, a private limited company is a corporate Form that gives the business a separate legal identity from its owner. Ultimately, it is also referred to as a pvt ltd company.

The Pvt ltd company was registered under the Companies Act of 2013 and is governed by the Ministry of Corporate Affairs (MCA). As evidence of registration, MCA issued the corporation’s CIN number and certificate. After 15 days have passed since a corporate certificate was given to a company, that company can begin operations.

Pvt ltd Company audit report

An organization review implies the investigation of its books of record to guarantee that they are right. The audit must be carried out by an auditor appointed by the business that has Private limited company registration in Chennai. The auditor’s ability to express their opinion is the goal of an audit of the company’s financial statements.

To determine whether the books of accounts, vouchers, and bills are accurate and properly maintained, the auditor will need to examine them. According to the Act and the Company Law Rules, a private limited company’s annual audit is a requirement for compliance.

What are the types of audit of private limited company?

A pvt ltd company that has Private limited company registration in Chennai is audited in a variety of ways for a variety of reasons. The following are examples of private company audits:

Statutory audit

Every pvt ltd company that has private limited company registration in Chennai, regardless of revenue or profit, is required to conduct a statutory audit.

A statutory audit must also be conducted by a business that is losing money. According to the Companies (Accounts) Rules, 2014, every pvt ltd company that has private limited company registration in Chennai must have its annual accounts audited annually.

After examining the information in the books of account, bank balance, and financial statements, the statutory audit seeks to ascertain whether a company that has private limited company registration in Chennai is providing an accurate representation of its financial situation.

Internal audit

The inside review of the pvt ltd company that has Private limited company registration in Chennai is directed according to the idea of its interior administration.

The prescribed businesses are required to appoint an internal auditor to conduct an audit of their activities and functions following the Act and the Companies (Accounts) Rules, 2014. The recommended pvt ltd companies that have Private limited company registration in Chennai that need to lead inward reviews are:

Private businesses with a turnover of at least Rs. 200 crores in the previous fiscal year Private businesses that have private limited company registration in Chennai with at least Rs. 100 crore in outstanding borrowings or loans from public financial institutions or banks internal audits is conducted to assess a business’s financial health and operational effectiveness.

They assist the internal management of company that has Private limited company registration in Chennai in reviewing its finances and making the necessary adjustments to improve operations’ efficiency.

Cost audit

According to the Companies (Cost Records and Audit) Rules, 2014, the following pvt ltd companies that have private limited company registration in chennai are required to conduct cost audits:

Companies listed in table 3(A) of the Companies (Cost Records and Audit) Rules are private limited companies that produce goods or provide services and have the following characteristics:

Pvt ltd companies that have private limited company registration in chennai engaged in the production of goods or providing services listed in table 3(B) of the Companies (Cost Records and Audit) Rules and having:

An annual turnover of at least Rs. 50 crore from all of its services or products. An aggregate turnover of at least Rs. 25 crores from each service or product

An aggregate turnover of Rs.35 crore or more for each service or product in the previous fiscal year, as well as an annual turnover from all of its services or products of at least Rs.100 crore

Appointment of Auditor

Statutory auditor

Within thirty days of its registration date, every pvt ltd company that have private limited company registration in Chennai is required to appoint an auditor to carry out the statutory audit of the business.

The appointment of the company’s first auditor, who will hold the position for five years, will be confirmed by shareholders at the AGM.

The organization can select just an autonomous rehearsing Sanctioned Bookkeeper (CA), CA firm or LLP with most of the accomplices rehearsing in India as its reviewer.

Internal auditor

The internal staff of the company that has Private limited company registration in Chennai or an outside party can carry out the internal audit.

Depending on the board’s decision, the internal auditor must be a CA, cost accountant, or another qualified professional.

The internal auditor of the company that has Private limited company registration in Chennai may even be an employee of the business.

Cost auditor

By the Companies (Cost Records and Audit) Rules, 2014, pvt ltd companies that have private limited company registration in chennai are required to appoint a cost auditor within 180 days of the beginning of the fiscal year. The cost audit can only be assigned by the business to an actual cost accountant.

A person who meets the requirements of Section 2(1)(b) of the Cost and Works Accountants Act of 1959 and includes a firm or LLP of cost accountants is considered to be a cost accountant in practice.

Due date of private limited company audit

Statutory audit

Before the annual general meeting (AGM) of the company that has Private limited company registration in Chennai, the statutory audit must be completed. The audit report must be delivered to the board by the statutory auditor.

The audit report should be filed with the ROC and attached to the financial statements of the company that has private limited company registration in Chennai. These are the due dates:

Within 30 days of the AGM, the audit report must be attached to the financial statement on form AOC-4 and filed with the ROC.

Within 60 days of the AGM, the annual return of the company that has private limited company registration in Chennai on form MGT-7 must also be filed. Each year, the AGM must be held before or on September 30.

Internal audit

The internal audit of the company that has Private limited company registration in Chennai has not been given due date. Before the AGM, the board must receive a report from the internal auditor.

Cost audit

Form CRA-3 must be used to submit the annual cost audit report to the board by September 30. The board will take into consideration and examine the cost report after receiving it.

Within 30 days of receiving the cost audit report in form CRA-4, the board must submit the cost report with relevant information to the Central Government.

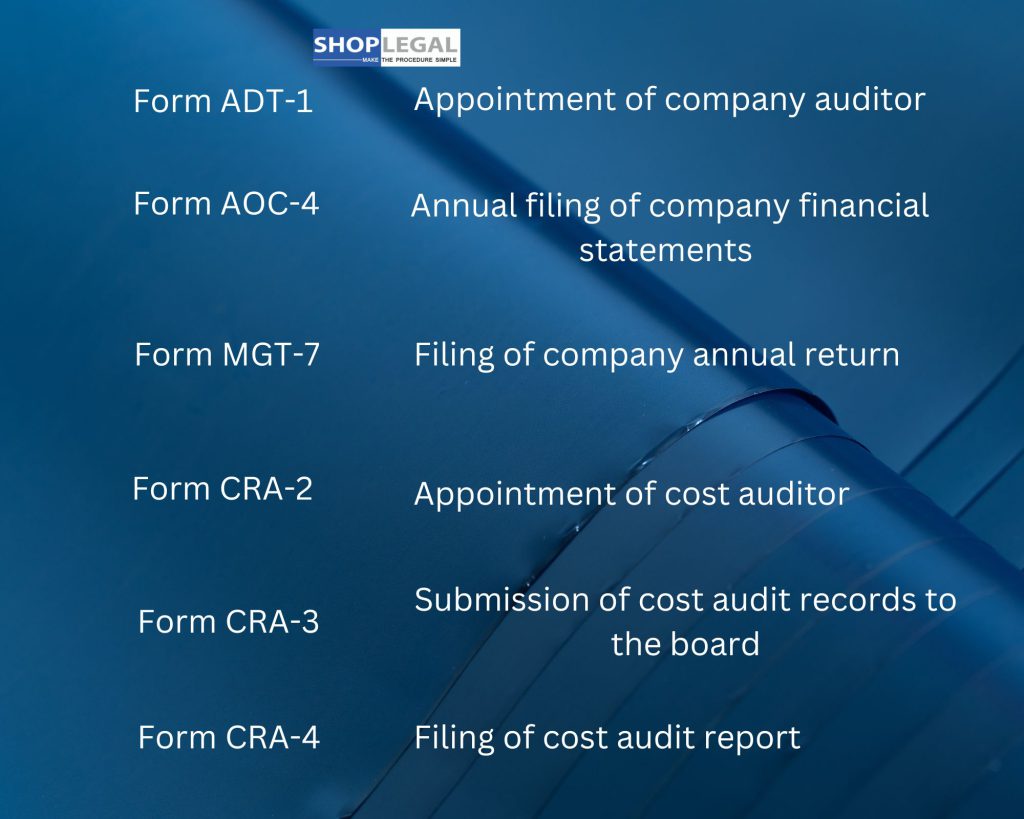

Forms for Audit Requirements

In connection with the requirements for an audit, the following ROC forms must be filed by a private limited company which has Private limited company registration in chennai:

Non-documenting of the above Forms with the ROC and non-accommodation of the legal review report and cost review report will draw in a penalty.

As a result, the statutory audit must be carried out by a private limited company that has Private limited company registration in Chennai by law.

They additionally need to direct the interior review and cost review when they satisfy the necessities referenced in the separate guidelines.

About Smartauditor

We Smartauditor are the best business service provider. We offer registration services at an affordable cost.