The same businessman had to choose the only avenue available for his company registration. In recent years, another option have been add A-One Person Company can be register when there is only one owner of the business. There are several pros and cons to choosing an OPC explained here.

One Person Company (OPC) is perfect for people who want to be the only entrepreneur. While sole proprietorship also offers the same benefits, in contrast to sole proprietorship, OPC offers limited liability and separate entity status, as well as providing good market position (confidence and respect increases).

Format of One Person Company:

One person company (OPC) can only be register as a private limited company. Therefore, all provisions applicable to a private company shall also apply to a single person company (OPC) unless otherwise specified in the relevant law or the rules made therein. Furthermore, an individual company can easily be transform into a private limited company or a public company. It is important to note that the word “one person company” must be mentioned at the end of the company name.

Benefits:

A separate legal entity

OPC is a separate legal entity and is capable of doing everything an entrepreneur does.

Easy funding

It is a private company; OPC can raise funds through venture capital, financial institutions, angel investors, etc. OPC This way one can graduate in a private limited company.

More opportunities, limited liability

One of the advantages of a one person company is that it has more opportunities, limited liability because OPC’s liability is limit to the value of the shares you have, the person can take more risk in business without impact or suffering damage to personal property. It promotes new, young and innovative start-ups.

fundamental requirements:

Minimum 1 shareholder and 1 director

The director and the shareholder may be the same person in OPC company

Minimum 1 nominee

The letters ‘OPC’ will be associate with the name of the OPC to distinguish it from other companies

OPCs face less compliance than private limited companies, so OPCs can focus more on other functional and key areas. An OPC can avail various benefits provided to small scale enterprises such as low interest rates on loans, easy entry of funds from the bank without any security deposit, various benefits under foreign trade policy and others. All these benefits in the early years can be a boon for any business.

Sole owner

You are the sole owner in making quick decisions, controlling and managing the business without following any elaborate procedures and methods adopted in other companies. The spirit of relationship inspires the business to grow further.

Credit rating

OPCs with bad credit ratings can also get loans. If the OPC’s rating is up to standard then the OPC’s credit rating will not be content.

Benefits under income tax law

Any remuneration paid to the director will be allow as a deduction under the Income Tax Act, as opposed to ownership. Other tax benefits are also subject to income tax law.

Receive interest on late payments

OPC takes advantage of all the benefits under the Enterprise Development Act, 2006. New start-up OPCs are micro, small or medium, so they are cover under this law. According to the Act, if the buyer or the recipient makes a late payment (payment is receive after a certain period of time), he is entitle to receive interest which is three times the bank rate.

Increase confidence and reputation

Any business entity that operates as a company always enjoys increased trust and reputation.

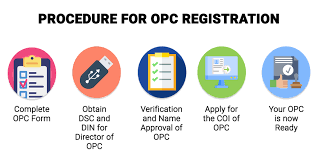

Registration process:

Apply for DSC: The fundamental step is to obtain the Digital Signature Certificate (DSC) of the proposed director, which requires the following documents:

Address Proof of address

Aadhar card

PAN card

. Photo

Email ID

• Phone number

Apply for DIN:

Once the Digital Signature Certificate (DSC) is done, the next step is to apply for the Director Identification Number (DIN) of the indicator director in spicy form with proof of the director’s name and address. Form DIR-3 is an option available only to existing companies. This means that from January, 2018, the applicant is not require to file DRI-3 separately. In OPC Three directors can now apply for the DIN spy form.

Name Approval Application:

The next step when including OPC is to decide on the name of the company. The name of the company will be “Abhaz (OPC) Pvt. Ltd.”

There are 2 options available to get name identification by applying in Form Spicy32 or by choosing 1 name using MCA’s Run Web Service and the importance of having that name. However, with effect from March 23, 2018, the Ministry has decided to allow two proposed names and one republishing (RFB) by reserving unique names (RUN service) for companies.

Required Documents:

we have certain documents to be prepare

a. Memorandum of Association (MOA) which is follow by the company or for which the company will be involved.

B. the Articles Association (AOA) lays down the by-laws that the company will be govern by.

C. As there is only 1 director and member, a nominee has to be appoint on behalf of such person as if he is incapable or dies and is unable to perform his duty; he will act on behalf of the director and take his place and Consent in Form INC-3 will be taken along with his PAN card and Aadhar card.

D. Proof of ownership of the owner and proof of registered office fee of the proposed company along with NOC.

E. Declaration and Form ICC-9 and DIR-2 Consent of the Director of References.

F. Declaration by professional certification that has been complied with.

Filling the form with MCA:

All these documents will be attached with Spicy Form, Spicy-MOA and Masala-AO and will be uploaded on the MCA site for approval with the Director of Professional and DSC. The page number and TN are generated automatically at the time of the company

Issuance of Certificate of Investment:

Upon verification, the Registrar of Companies (ROC) will issue a Certificate of Incorporation and we will be able to start our business.