Since July 1, 2017, all of India has been subject to Goods and Services Taxes (GST). It is necessary for representatives or business entities that are currently enrolled in any existing tax administration to enrol in the GST. Regardless of any threshold limit, GST registration is required of every specialist and proprietor who is previously listed under any tax administration.

The central sales tax, service tax, state VAT, central excise duty, entry tax, luxury tax, purchase tax, entertainment tax, state surcharges, and tax on lotteries are just examples of the indirect taxes that will no longer exist once the GST is made public. However, if you are not registered with any tax administration and provide goods or services, you will only be eligible to join when your annual total turnover exceeds the threshold.

At the national level, the GST threshold limit does not apply uniformly across India. The GST council set Rs. as the threshold limit. The current threshold is Rs. 10 lakh for the North Eastern states and whatever remains of India. 20 lakh.

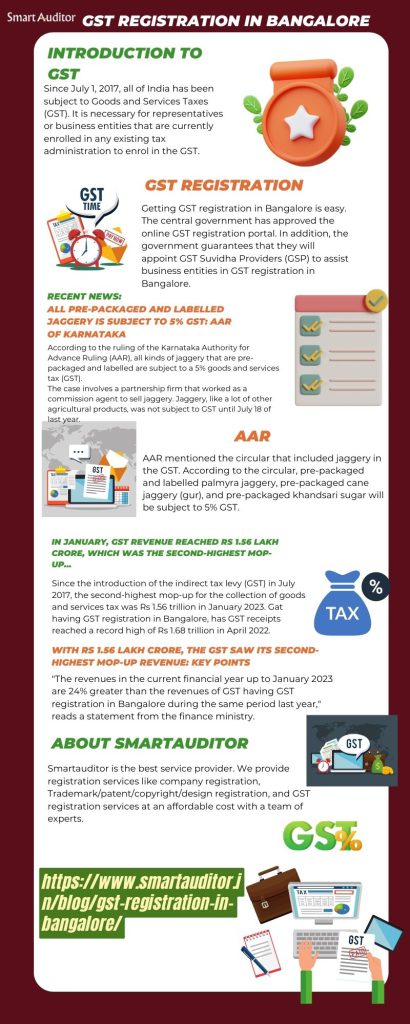

Introduction to GST

Under the GST regime, the majority of indirect taxes will be eliminated and combined into distinct tax brackets. The majority of indirect taxes will be eliminated by GST, resulting in a business-friendly and hassle-free business environment. It is anticipated that the introduction of GST will significantly ease business transactions in India.

GST that can have GST registration in Bangalore is not a novel idea. India is so late to the GST party that it is already in use in approximately 160 countries. It is anticipated that it will lower input costs by 10% and increase GDP by 1-2 per cent.

The proposed GST law does not meet all of these criteria. The draft of the GST which can have GST registration in Bangalore satisfies the requirements of the state, political parties, centre, and others. However, we ought to recognize that the world is not perfect. The GST does not cover basic customs duties, property taxes, alcohol, tobacco, or petroleum.

GST registration process

Getting GST registration in Bangalore is easy. The central government has approved the online GST registration portal. In addition, the government guarantees that they will appoint GST Suvidha Providers (GSP) to assist business entities in GST registration in Bangalore. In this section, we provide a step-by-step guide to the India GST registration process.

1: By visiting the GST website, each existing taxpayer in any tax regime must access the GST registration portal for GST registration in Bangalore.

2: Select the checkbox to accept the terms and conditions by clicking the new user login for GST registration in Bangalore.

3: After entering the information provided by your VAT department, such as a temporary password and provisional ID, press Login.

4: Press Continue after entering your email address and telephone number.

5: A one-time password (OTP) will be sent to your email and mobile number. Click the Continue button after entering the OTP in the required field.

6: Enter your username and password to log in again. If you forget your password, answer a security question.

7: You must now return to the GST portal and select the existing user login option. Now, enter your username and password, which you created in step 6, to log in.

8: After logging in, you must fill out some information and upload the necessary documents before clicking Save to continue for GST registration in Bangalore.

9: Complete the information about your company’s partners and owners. Then you must fill out the Authorized Signatory information.

10: After entering the necessary information and uploading the document, select “Save” and “Continue.”

11: Complete the information about your company’s primary location. Click Save to proceed after entering the commodity information.

12: Complete the bank account information and upload the necessary documents.

Submit a digital signature certificate (DSC) by clicking the verification button for GST registration in Bangalore.

Please be aware that DSC is required for LLPs and businesses.

13: To save and update the information and document you have provided, click the Submit button. From the pop-up window, click the sign after clicking Proceed.

14: A message will appear on the screen if your submission is accepted for GST registration in Bangalore.

Please note that the validation of the DSC PIN results in the display of the success message.

Within the next 15 minutes for GST registration in Bangalore, you will receive the acknowledgement via email and text message to your mobile number.

Your mobile phone number and email address will receive the Application Reference Number (ARN).

Recent news

All pre-packaged and labelled jaggery is subject to 5% GST: AAR of Karnataka

According to the ruling of the Karnataka Authority for Advance Ruling (AAR), all kinds of jaggery that are pre-packaged and labelled are subject to a 5% goods and services tax (GST).

The case involves a partnership firm that worked as a commission agent to sell jaggery. Jaggery, like a lot of other agricultural products, was not subject to GST until July 18 of last year.

On that day, pre-packaged and labelled jaggery became subject to the GST which can get GST registration in Bangalore.

However, the business stated that it deals in jaggery, which is sold in thread-stitched, wrapped loose sheets weighing 5 kg, 10 kg, and so on. It stated that none of the jaggery lumps is identical in weight and that they are not packed with any substance.

AAR mentioned the circular that included jaggery in the GST. According to the circular, pre-packaged and labelled palmyra jaggery, pre-packaged cane jaggery (gur), and pre-packaged khandsari sugar will be subject to 5% GST.

The authority stated that as a result, all varieties of pre-packaged and labelled jaggery will be subject to 5% GST.

“The AAR ruled that all types of pre-packaged and labelled jaggery will be subject to GST having GST registration in Bangalore at 5%,” stated Sandeep Sehgal, partner tax at AKM Global. The language of the circular appears to have a much broader scope,” he stated.

In January, GST revenue reached Rs 1.56 lakh crore, which was the second-highest mop-up…

Since the introduction of the indirect tax levy (GST) in July 2017, the second-highest mop-up for the collection of goods and services tax was Rs 1.56 trillion in January 2023. Gat having GST registration in Bangalore, has GST receipts reached a record high of Rs 1.68 trillion in April 2022.

With Rs 1.56 lakh crore, the GST saw its second-highest mop-up revenue: Key Points

According to data from the finance ministry, the central GST was Rs 28,963 crore, the state GST having GST registration in Bangalore was Rs 36,730 crore, the integrated GST was Rs 79,599 crore (including Rs 37,118 crore collected on goods imports), and the cess was Rs 10,630 crore of the gross GST revenue collected from January 2023 until 5 p.m. (including Rs 768 crore collected on goods imports).

By 10.6%, the amount that was collected in January 2023 was Rs 1.41 trillion more than it was in January 2022.

On a sequential basis, the collection was 4.7% higher than December’s Rs 1.495 trillion.

“The revenues in the current financial year up to January 2023 are 24% greater than the revenues of GST having GST registration in Bangalore during the same period last year,” reads a statement from the finance ministry.

According to government records

The government contributed a total of Rs 38,507 crore to the central GST and Rs 32,624 crore to the SGST in January 2023.

For January 2023, the central government received Rs 67,470 crore in CGST revenue and the states received Rs 69,354 crore in state GST revenue after routine settlement.

8.3 crore e-way bills were issued in December 2022, the most ever and significantly more than the 7.9 crore e-way bills issued in November 2022.

In comparison to the average monthly mop-up from GST of Rs 1.23 trillion in 2021-22, January’s revenues are in line with this fiscal year’s average mop-up of Rs 1.5 trillion.

This fiscal year, the amount of GST that can get GST registration in Bangalore collected has surpassed Rs. for the third time, 1.50 lakh crore.

Along with the normalization of economic activity and the effects of high inflation, the government has taken several steps to increase tax compliance and broaden the tax base, both of which have helped collections.

What is the percentage of GST return in 2022?

The finance ministry claims that over time, a significant percentage of GST returns (GSTR-3B) and statements of invoices (GSTR-1) have been filed at the end of each month.

In the quarter that ended on December 31, 2022, 42 crore GST returns were submitted in total, up from 2.19 crore the year before.

GST return is now easy to claim when you have GST registration in Bangalore.

Economic survey

Below is the economic survey of GST that can get GST registration in Bangalore.

Economic survey 2022-23

GST which can get GST registration in Bangalore has stabilized and become an important source of revenue for the federal and state governments. There will be over 1.4 million GST taxpayers by 2022, up from just over 70 thousand in 2017.

The pandemic-related rapid economic recovery, the nationwide campaign against fake bills and GST evaders, the recent introduction of numerous systemic changes, and various rate rationalization initiatives taken by the GST Council to correct the inverted duty structure were all mentioned in the article as reasons for the rise in collections of GST that has GST registration in Bangalore.

About Us

Smartauditor is the best service provider. We provide registration services like company registration, Trademark/patent/copyright/design registration, and GST registration services at an affordable cost with a team of experts.